Call option value calculator

Our tools and algorithms help investors design option strategies. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

European Option Definition Examples Pricing Formula With Calculations

The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your.

. With this options calculator you can find the theoretical price for both call and put options. Call option profit or loss 3500 150 3500 Call option profit or loss 3500 3650. Talking through the example in the.

When you buy a call option it gives you the option to buy shares at the agreed upon strike price. See how this trading course helps small investors earns Extra Income. About The Option Value Calculator Black-Scholes This tool lets you value European put and call options using the Black-Scholes model.

A Call option represents the right but not the requirement to purchase a set number of shares of stock at a pre-determined strike price before the option reaches its expiration date. It also calculates and. There are basically two kinds of.

Ad With over 40 years experience in options trading we have a robust set of tools. You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model. The GE 30 call option would have an intrinsic value of 480 3480 - 30 480 because the option holder can exercise the option to buy GE shares at 30 then turn around.

This tool can be used by traders while trading index options Nifty options or stock. Options involve risk and are not suitable for all investors. As a derivative product options derive their value from an underlying asset such as Stocks bonds indices foreign currencies and even commodities.

Options profit calculator will calculate how much you make and the total ROI with your option positions. Option Price Delta Gamma Calculator This calculator utilizes the inputs below to generate call put prices delta gamma and theta from the Black-Scholes model. This tool lets you value European put and call options using the Black-Scholes model.

Call option profit or loss 150. Change any of the sliders to see their effect on the call and put prices. Lets say we have a call option on IBM stock with a price of 15.

Suppose Jane bought call options for a. Change any of the sliders to see their effect on the call. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Our tools and algorithms help investors design option strategies.

However the call option value as seen on the NSE option chain is. Options profit calculator Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

Black-Scholes Calculator for the Value of a Call Option This calculator uses the Black-Scholes formula to compute the value of a call option given the options time to maturity and strike. The calculator is suggesting the fair value of 8100 call option should be 8114 and the fair value of 8100 put option is 7135. Ad With over 40 years experience in options trading we have a robust set of tools.

Calculate a multi-dimensional analysis. Learn How To Trade Options Like The Pros. To start select an options trading strategy.

We support the calculation of American and. With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

Free Option Calculator based on Black-Scholes with Call and Put Prices Greeks and Implied Volatility Calculation. Options Calculator is used to calculate options profit or losses for your trades.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

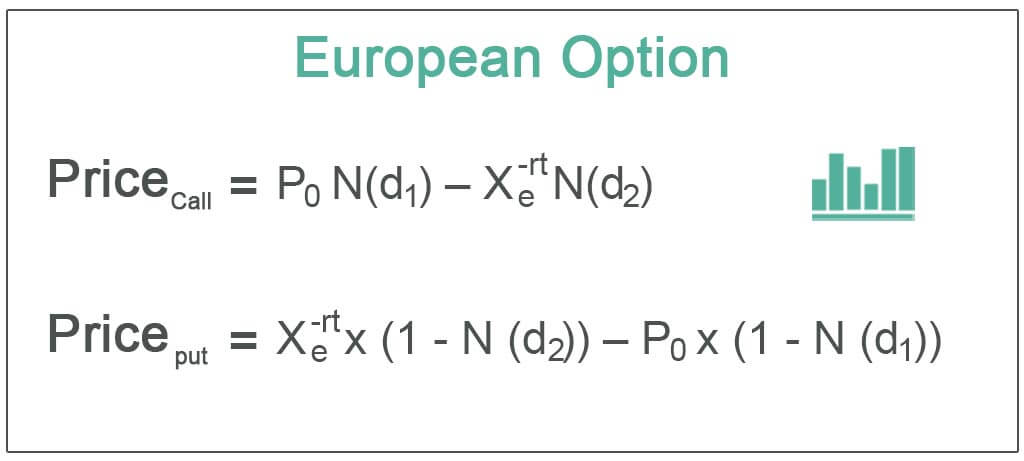

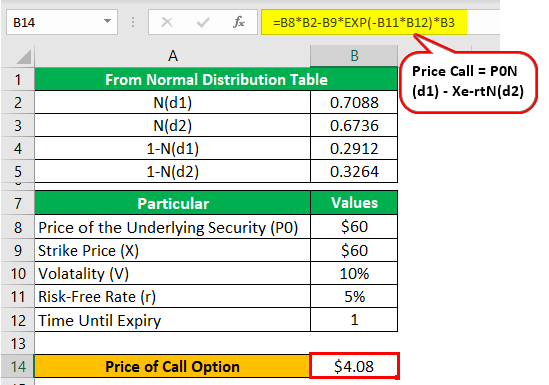

European Option Definition Examples Pricing Formula With Calculations

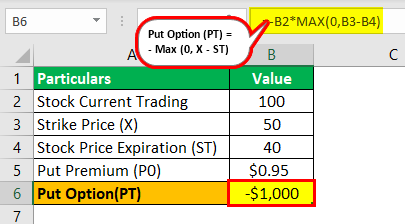

Put Option Meaning Explained Formula What Is It

European Option Definition Examples Pricing Formula With Calculations

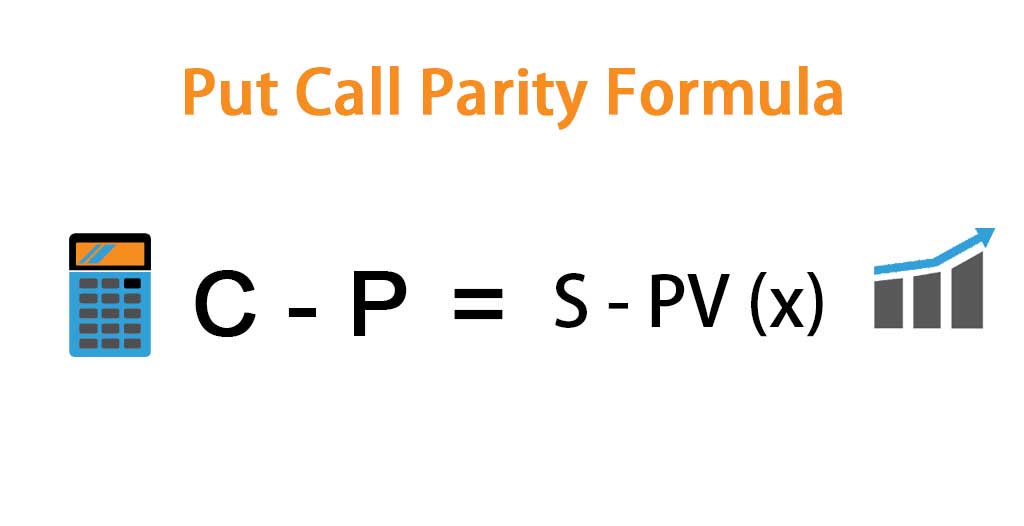

Put Call Parity Formula How To Calculate Put Call Parity

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Call Option Calculator Put Option

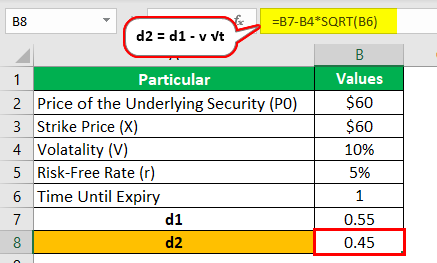

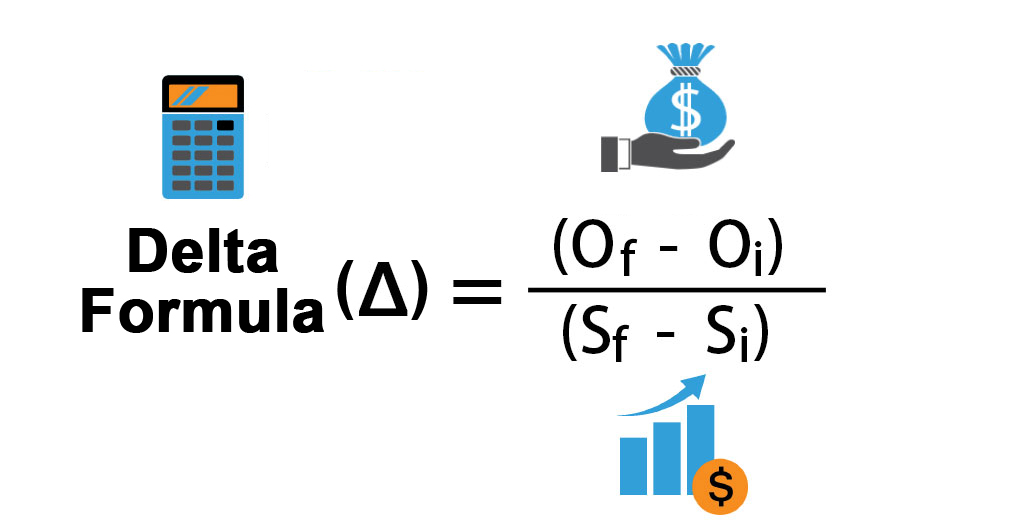

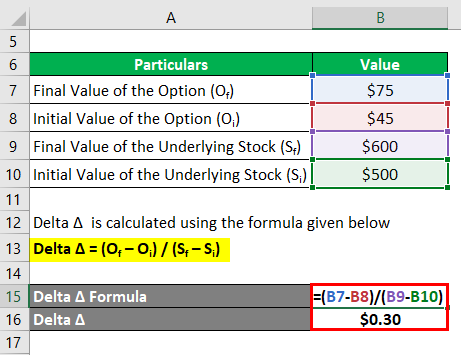

Delta Formula Calculator Examples With Excel Template

Delta Formula Calculator Examples With Excel Template

The Options Industry Council Oic Options Pricing

Option Value Calculator Option Price Calculator Option Pricing Formula

Summarizing Call Put Options Varsity By Zerodha

Summarizing Call Put Options Varsity By Zerodha

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation